Blockchain & Criptocurrency

Juarez C. da Silva Junior

(Brazil, 2021)

Blockchain

it’s a recording system of transactions based on database and networks, the name gives a basic idea of the thing, processing of blocks of data containing transactions in a chained way, like a big digital ledger, it’s immutable and fraud proof, which could be used for several things like digital assets, authentication and identification, beside others.

Centralized, descentralized and Distributed networks

Centralized network is the one with a single network “owner”, only that point allows information sharing to the others. In another hand, descentralized network has several “owner points” interconnected, it’s possible to “divert routes” of sharing in case of failures and also to maintain backups. The distributed network completely ends with the possibility of centralization, all points can communicate with each other.

So, blockchain is trully descentralized or distributed network? How is the block structure?

Well, we can say there’s a mix of the shapes, since the data is not saved in a single organization and only one server, but among all the miners and other actors on the network. The exchanges for example have internal centralization, but they work as descentalized points for the network, so all information on a blockchain can be found in all of network machines, means distributed too.

About block structure, basically a block is composed of a header and a body. The header contains the hash from the previous block, a timestamp, the nonce (arbitrary number) and the Merkle root. Merkle’s root is obtained from the combination of the hashes of the various transactions in the body. In it is the Merkle tree, a combination of transactional hashes and the data of transactions, as input, output, timestamp, signature, value.

Mining farm and Bitcoin pricing

The process of obtaining new coins to the market is called mining. It’s done by the validation work of miners over transaction blocks, which with their machines solve mathematical problems that make this release, “farm” is nothing more than big sets of computers working together to solve such matters.

Bitcoin’s precification is basically obtained from the suply and demand rule, as well as expectations and events in the real world. A mix of what happens to fiduciary coins and stocks. The higher demand higher price, lower demand or massive sales lower price. Mining difficulties, speculations with good or bad economic news or feelings overall or at specific market can influence as well.

Merkle tree

It’s a mathematical structure that allows the safe and unique identification and consistency of a block in blockchain. Each transaction has a hash that’s like a hexadecimal code, from each pair of hashes forms a new hash a level above,

the combination of the pairs of hashes on this level are equally combined to form a new level up and so on until there is a single hash, which is an single-possible representation from the information on that block and is called Merkle’s root.

Ledger and a brief history of blockchain

In common accounting, a ledger is what contains detailed and updated records of a company transactions. When we talk about blockchain ledger we have a type of digital version of that in the general sense, it’s the general record of block transactions processed in the network, but descentralized/distributed, all machines in the network maintains a copy of these records. In the case, ledger is public, immutable and fraud-proof.

The history of Blockchain doesn’t begin exactly with its development and application but with the concerns of the so-called Cypherpunks, in the early years of the 1990s. They were a group emerged in California and formed by mathematicians, programmers and cryptographers concerned about privacy and security in the growing wave of popularization of cyber technologies. From 2007, the Bitcoin project begins, which introduces the pratical basis of Blockchain technology use. In 2008, was launched an article signed by Satoshi Nakamoto, an alias, unconfirmed until today that it would really belong to. In 2010, the first purchase occurs by using bitcoin, at least publicized, two pizzas, for 10,000 bitcoins, it’s known that bitcoin was also used in dark transactions like in “Silk Road”. After that times the technology behind the Bitcoin became considered for other applications beyond the cryptocurrency itself, with the evolution of technology emerged the smart contracts, altcoins and a whole range of new descentralized applications.

Why should one use Blockchain? Cryptocurrencies definition and uses

There are several possible motives and uses, certain economic players have recently discovered advantages in the use of blockchain, for example safe validation of transactions. From this government and financial institutions think about implementing blockchain in their operations, companies and independent artists who depend on intellectual property can also benefit especially from this technology.

Although a lot of people have difficulty defining what is cryptocurrency, like the expert character performed by Elon Musk on Saturday Night Show, we can say that is what we can call descentralized digital money or coins, obtained and operated in a safe way in systems where the information and the data are encrypted in a blockchain network. Among the advantages is anonymity and the main, the non-control by Governments.

Cryptocurrencies can be used, for adoption as a means of payment, international transfers with low cost and high speed, gambling, savings or investment, thanks to high value increase possibilities, can also be linked to niches and specific projects.

Cryptography and Bitcoin

Cryptography is a set of methods that are intended to prevent a third part of understanding the contents of a message, for long has been restricted to spies and military, but today is used in several types of communications and transaction validation.

Bitcoin was the world’s first cryptcoin, largely adopted as digital payment, and mostly as investment, possesses the biggest market cap of all and normally good valuation.

Bitcoin’s advantages and disadvantages

Advantages

Decentralized service, no fees or else low, Safe network, anonymity, user control, not affected directly by inflation, worldwide utilization, normally good valuation.

Disadvantages

Processing of transactions still relatively slow compared to altcoins, the Bitcoin network needs optimizing, It’s not popularly adopted as payment means yet, environmentally questionable mining process.

Bitcoin Wallet

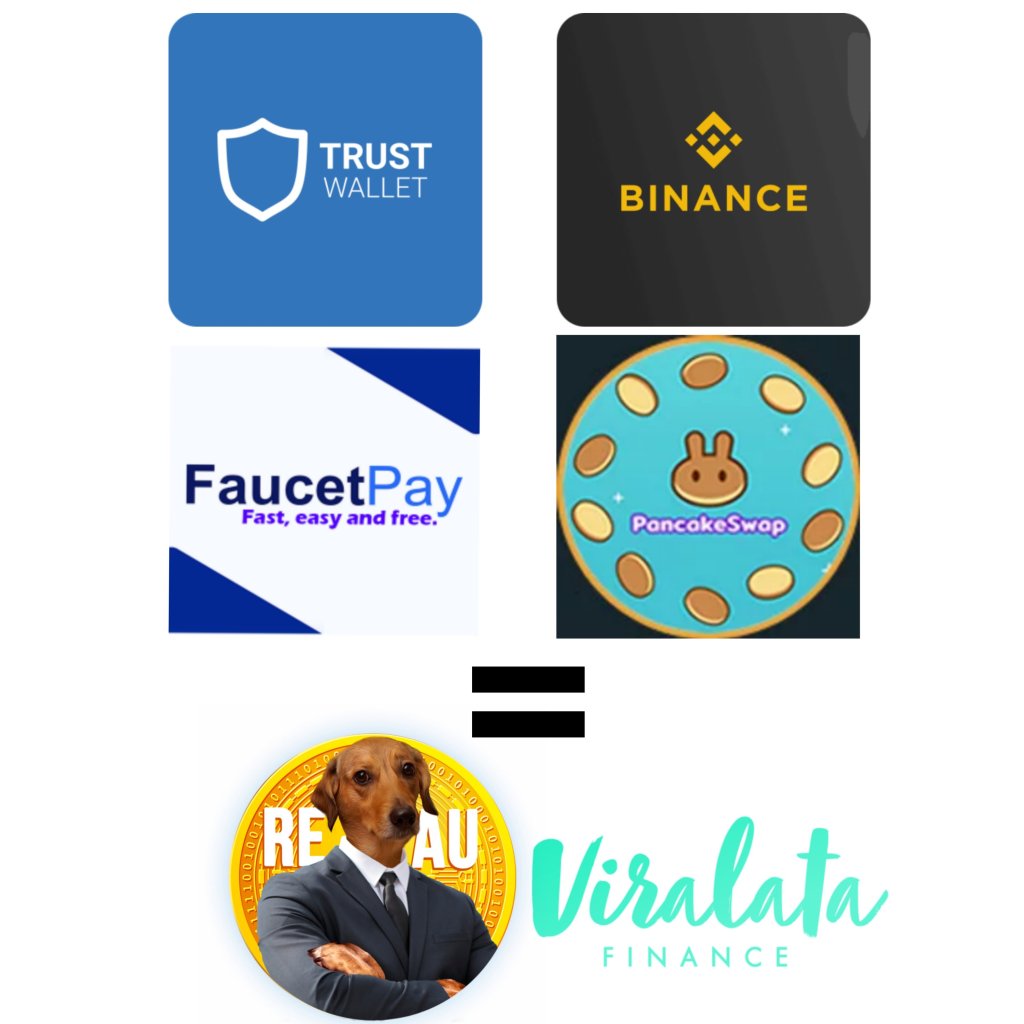

Wallets, as his name suggests are locations to maintain money, in this case Bitcoin tokens, or other cryptocurrencies and digital assets with lots or some security like access pins, long recovery phrases, encryption, 2FA codes, dependeding on the choice. The types can vary, basically the wallets can be custody in exchanges, desktop

computers, mobile devices, can also be specific physical devices or even the so-caldepends per wallets.

Basically, you’re gonna need a Bitcoin exchange, and for use as a means of payment also a Bitcoin wallet. Exchange is where your fiduciary money will be converted to bitcoins, in it, you can also make the reverse process by getting fiduciary coin in exchange for your Bitcoins. For mere investment, swing trade or reserve it is possible to leave your Bitcoins taken into your wallet in your exchange account, but is recommended to keep a wallet in an external device of your own.

Bitcoin exchange, steps

The steps depend on some factors,

First create an account and then make a deposit, you can make an online deposit or in person to your account at the exchange, sometimes buy it with a credit card too.

Second, swap your fiduciary balance to Bitcoin, OK, you already have bitcoins.

Third, if you want, you can now transfer from your account wallet to your external wallet using Bitcoin’s respective address on it, you can also transfer it to any other valid address you want. With the Bitcoins in your personal wallet, you can then use them for payments and transfers.

Fourth, you can either buy or receive bitcoins in your own wallet addresses, and depending on your wallet, to make exchange with other cryptocurrencies.

Fifth, withdraws in fiduciary currencies can be made indicating the address of wallet to swap Bitcoin in an exchange and generally the number of the bank account, in general preregistered.

Bitcoin cash, differences for Bitcoin

Bitcoin Cash is a Bitcoin hardfork. The code of Bitcoin Is BTC, of Bitcoin Cash Is BCH.

The main difference between both nets is the maximum size of block allowed by each. The size of the BCH block is bigger, so it have less time processing and off course better fees. Bitcoin has a higher market cap and also more value.

Segwit2x, difference between soft and hard fork

Basically Segwit2x is a hardfork from Bitcoin proposed in 2015, a proposal that doubles the size of the transactions block in a “dimmer way”, doesn’t add great news, but compiles some previous features alteration proposals. It compete with other hardforks like Bitcoin Cash.

Forks in Blockchain are forks that occur in protocol. Every cryptocurrency can suffer a fork, it happens when there are disagreements between different user groups. So new chains are created as alternative to the initial. In other words, a division that works under new rules or ancient rules.

In a hard fork, new rules prevent compatibility with the old ones, we have a new thing, at soft fork just an update, not incompatibilization.

What Ethereum is, differences for Bitcoin

Ethereum like Bitcoin is a Blockchain network with a cryptoccurrency of its own, there are similarities between both like mining, as there are differences.

The most visible difference between the two is that Ethereum was created to process apps and decentralized services, is strong for smart contracts and with it created its own token, Ether, the ETH which is used for payments of fees, but also as a reserve of value. Ethereum is the prime competitor of Bitcoin, has smaller market cap and value, but if it can optimize his network, reduce the fee value and mainly to change the mining scheme, it can overtake Bitcoin.

Ethereum, merits and demerits

Merits

Ethereum is used for more complicated and diversified applications than for example the Bitcoin Blockchain, it allows the creation of smart contracts. It has a more reliable network structure, safer than competition, also faster and efficient. It’s a descentalized platform, which guarantees always online applications. There are constant updates, which improves performance and also possibilities of new features. It allows different ways of picking up resources for projects. The mining process seems to be heading a more sustainable way.

Demerits

Smart contracts can be made with mistake coding, leaving explorable vulnerability breaches, Ethereum has no contract renounced project, can suffer personalist influences because the project has a knowed owner. The scalability of the Ethereum network generates great size and greater need for storage spaces, which could be more troubled than in the Bitcoin Blockchain case. Ethereum’s DAO applications still suffer failures and attacks, which narrows down to the confidence of choice and use. Finally, the transaction fees on the network are still elevated.

Ripple, Litecoin and Dash

Ripple is a protocol dedicated to distributed payment, although it has a coin of its own for use in its ecosystem, the XRP, the platform also has support for other cryptocurrencies. Your main applicability is instant and safe payments. We can say that a good definition for the platform is to be at the same time a solution “Bank and WU Killer” since the transaction assets can represent both fiduciary coins and assets or be cryptoactives, all with lower fees, on the other hand can ease up for financial institutions to integration to the cryptomarket and benefits of Blockchain technology. As the advantage the main highlight is the speed of processing, often rapid in relation to Bitcoin, the main disadvantage is that like Bitcoin is not very sustainable, it requires a lot of electric energy.

Litecoin is basically a cryptocurrency “Bitcoin like”, was created in 2011 and as the name suggests, to be a lighter alternative to Bitcoin. Has fast transactions and very lower fees. Litecoin’s main feature is to be peer-to-peer, which means it’s used as a means of payment where people pay directly to each other without intermediation. Running to reach the TOP 5 of the cryptocurrencies.

DASH is a cryptocurrency from a DAO (descentralized organization), actually a Bitcoin hard fork (from 2014). Its main feature is the speed of ultra-rapid transactions. Another point is that the DASH can be used for votes at governance system, has two-layer structure, regular blockchain and masternode. The cryptocurrency was initially called XCoin, then became very used on the dark web, finally got its current name, trying to get rid of the negative image.

Monetary policy

Is the form as a coin is placed or removed from circulation. In the case of Bitcoin, the emission is for payed mining, that’s the only way to increase the amount of bitcoins available at the market. Unlike the controlled trust coins, issued in a unlimited way by a central bank, generally cryptocurrencies already emerge with a possible limit, the Bitcoin’s, for example, is 21 million units. The obvious effect of this is to do deflationary cryptcoin, with the increasing demand and coins shortage, progressively the value grows throughout time.

Tax regulations related to Bitcoin

The taxation of cryptocurrencies, including Bitcoin varies from country to country. Usually the rules are similar to other assets, tax incidence occurs from certain value.

Bitcoin in the retail and health industry, role It play in education

Nowadays several large retail networks already accept Bitcoin directly as payment, there are also platforms that indicate where you can buy with Bitcoin, others who do intermediation, you buy and pay by using bitcoin and they pay the seller using the means which it accepts.

Talking about health care Industry maybe should better to speak not about Bitcoin but technology behind it, the blockchain, that can be used for global health records, better supply chain control and transparency, medical AND nursing personnel check and health insurance smart contracts. That might also make easier medical history in the refugees case…

In the case of education equally the Blockchain technology can give global control, credentials and certifications and diplomas verification, school records. Bitcoin can be used for fees payments and other things.

FIAT currency and DAO

Initially money was based on a gold related standard system or another commodities, the emergence of paper coin allowed conversion of paper bills to gold because it was direct relation to gold that the government owned.

Fiduciary currencies, also called FIAT Currencies have its value guaranteed by the emitter government, without relation to a commodity or something else. The emergence of the fiduciary currencies happened in China centuries ago. Some European countries uses FIAT since the 18th century.

In 1972, the U.S. government completely abandoned the gold standard parity for the dollar, and with that almost all the other currencies in the world became also FIAT. The governments and central banks of each country have a lot and almost complete control over the respective monetary systems. But the unbalanced emission of money can lead to hyperinflation and economic collapses.

DAO

Decentralized Autonomous Organization is a kind of organization in which the rules are set in the blockchain system using smart contracts, generating total transparency to all users. There is no central server or entity that supervises the processes, control is made by shareholders involved in the project. The main goal in a DAO is to allow operational and funding of your projects through your smart contracts.

One cool thing about DAOs is democracy, there are votations of the proposals made at the blockchain, under supervision of some “admins” or voluntary “devs” (developers). The idea is simple, in the votation are used to represent votes the amount of cryptoactives invested by each member in certain projects, more investment and confidence, more “voice”.